Savings Basics

You have goals in mind. Use these strategies to get where you want to go.

Creating a savings plan and putting it into action is a great first move. Use these simple steps to build your savings foundation.

Create a budget

This will be based on your monthly income, expenses, and savings.

- Look at your most recent monthly statements to track your income and expenses. Knowing how you spend your money can help you adjust or eliminate non-essential purchases.

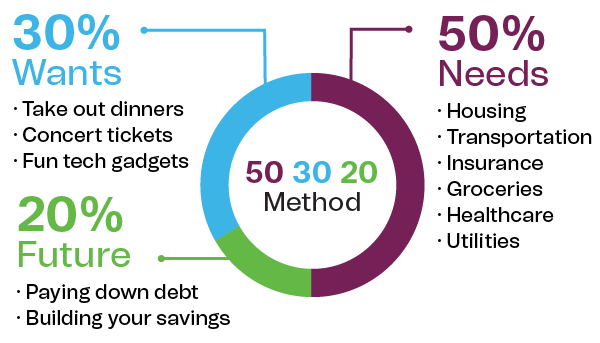

- Use the 50/30/20 budget — spending roughly 50% of your after-tax dollars on necessities, no more than 30% on “wants,” and at least 20% into savings or paying off debts.

- Our Savings Goal Calculator can help you develop a roadmap to make your hard-earned income work for you.

- Stick to your budget plan over time to help reduce debt, cut back on impulse purchases, and increase savings for emergencies, large expenses, and other financial goals.

Save early for retirement

Even small, regular contributions toward your retirement can grow into a healthy retirement savings account.

- Compound interest (earning interest on interest) over time has a tremendous impact on your long-term retirement savings. Automate the process. If your employer offers a 401(k) plan, take advantage of it, along with the pre-tax savings on your earnings.

- Open a Health Savings Account (HSA). You can contribute pre-tax dollars, pay no taxes on earnings, and withdraw the money tax-free now or in retirement to pay for qualified medical expenses.

Build your savings

Creating enough cushion to cover emergencies puts you in control of your finances. As a general rule, try to maintain enough savings to cover three to six months of your regular expenses.

- Establish a separate savings account for each of your savings goals — contributing a certain amount each pay period. We make it easy by offering Choice Savings accounts. You can open multiple savings accounts and give them names that represent your financial targets (like emergency, insurance, or vacation).

- Set up automatic transfers from your checking to each savings account each pay period to stay on track.

- Use our Round-Up Savings to grow your savings automatically. Every time you make a purchase with your Everwise Debit Mastercard®, the purchase amount is rounded up to the nearest dollar and the difference is transferred from your checking to your savings account. You'll quickly see how spare change adds up.

This document is for educational purposes only and doesn’t constitute tax, legal, or accounting advice. The following is general information, not recommendations. Please consult with an attorney or tax professional for guidance.