Switch Kit

Changing jobs, schools, or hometowns? That can be challenging. Moving your accounts to Everwise? That's no sweat.

Better rates, lower fees, and friendlier service should be a strong motivator. And we can help seal the deal by offering you a simple, straightforward guide to switching to us.

Step 1

Open a checking account

Select the checking account that is best for you. The choice is yours. No matter which checking account you select they all provide you with:

- 24/7 access with online banking and our mobile app

- Access to more than 700 no-fee ATMs across Indiana and Michigan, as well as 30,000-plus reduced-fee ATMs nationwide

- A Debit Mastercard® that earns you cash back

Step 2

Switch your direct deposit

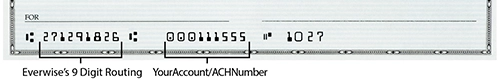

Transfer your direct deposit (payroll, Social Security, pension, investment/brokerage, etc.) by downloading the form below or simply contacting your employer or the business/organization initiating the deposit. Provide them your new account number and Everwise's routing and transit number (271291826).

Resources

- Social Security Administration: (800) 772-1213

- Department of Veterans Affairs: (800) 827-1000

- Direct Deposit Form

Step 3

Review your account activity/statements

Gather all relevant information regarding your existing accounts — such as automatic payments, outstanding checks, and pending payments. Be sure to leave enough money in the account to cover these items until you transition to your new Everwise account. Don’t forget to include any monthly account fees that may be assessed.

Step 4

Switch your automatic payments

Set up your automatic payments (utilities, insurance, etc.) with your new Everwise account. It's easy to make online payments with your Everwise debit card or use the Bill Pay feature in online banking. You can also download and complete our automatic payment form to provide businesses with your new account information. Allow enough time, at least 3 to 5 business days, for the transfer to take place to avoid a late payment.

Common automatic payments

- Mortgage/rent

- Vehicle loan

- Insurance/premiums

- Utilities (heat, water, garbage, electric, etc.)

- Other services (internet provider, phone/cell, health club, daycare, entertainment, etc.)

- Automatic payment form

Step 5

Close your account at your previous financial institution

Before you officially close your old account, you'll want to make sure all checks have cleared and any direct deposits or automatic payments are transitioned to your new Everwise account.

- Download and complete this form below and provide it to your prior financial institution.

- Once your account is closed, it's a good idea to destroy unused checks, deposit slips, and ATM or debit cards.

Switch Kit FAQ

Contact our Member Services team at (800) 552-4745 with any questions you may have.

You can visit the mobile and online banking page to enroll OR download our mobile app for Android or iPhone.

On Desktop: Click on your account tile. Your Routing & Transit, ACH Number, and Member Number will display on the left side at the bottom of the screen.

On Mobile: Tap your account tile. Find the light gray bar at the top of the white account tile. Swipe down. Your Routing & Transit, ACH Number, and Member Number will display at the bottom of the screen.

You can also find this information at the bottom of your check:

Click/tap the My Documents tile on your home screen. If it is your first time here, the agreement/disclosure will automatically pop-up. Please review the agreement and scroll down to the bottom of the agreement to select "Agree". You will then be enrolled in eStatements, in addition to receiving other notices and documentation electronically.

You can visit most branches to receive an instant issue Debit Card.

You can order your first full set of checks by calling Member Services at 800-552-4745 or visiting your nearest branch.

You may also like

Checking

Simplify money management with flexible checking features that fit your lifestyle.