Credit Basics

Everyone loves the convenience of a credit card. Here's how to manage it wisely.

There's a lot that goes into that quick purchasing power a credit card provides. Dig into the basics of how credit works so you can keep all your financial goals on track and reduce the burden of consumer debt.

What is a credit report?

It's a record of your credit activity and current credit situation, such as loan repayment history and the status of your credit accounts.

Lenders, insurers, employers and others can obtain your credit report from a credit bureau or consumer reporting agency to determine whether you are a good candidate.

Credit reports often contain:

- Personal identifying information: Name, address, full or partial Social Security Number, date of birth and employment information

- Your past and existing credit: The amount you owe creditors, terms of your credit and your payment history

- Your public record: Court judgments against you, tax liens against your property, whether you have filed or bankruptcy or have unpaid bills which have been turned over to collection agencies

- Inquiry information: Companies make a credit inquiry anytime you apply for credit

Check each of your three credit reports once a year to make sure information is accurate and no accounts have been opened in your name without your knowledge. You can get a free copy of your credit report from each credit bureau once a year by visiting annualcreditreport.com or calling (877) 322-8228.

Contact the three main credit bureaus to correct an inaccuracy, add a fraud alert, freeze access to your credit report and more:

What is a credit score?

This three-digit number estimates how likely you are to repay borrowed money. The most commonly used credit score model, FICO, has a range of 300 to 850.

Excellent credit: 800+

Very good credit: 740-799

Good credit: 670-739

Fair credit: 580-669

Poor credit: less than 580

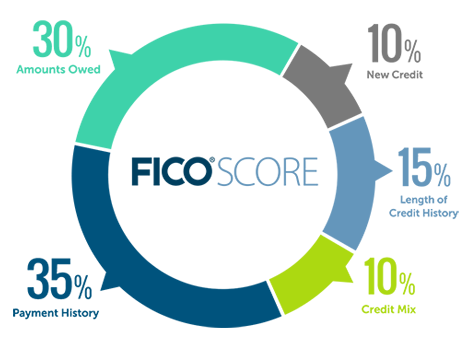

These factors influence your credit score:

- Payment history (35%): Paying your bills on time makes a big impact on your overall credit score, accounting for up to 35%.

- Outstanding debt (30%): Keeping balances well below credit limits and paying off those balances can improve your score.

- Length of credit history (15%): In general, a longer credit history will increase your credit score, because creditors can see if you’ve been making payments responsibly.

- Types of accounts (10%): Showing how you successfully manage a mix of credit accounts – e.g., credit cards, retail accounts, installment loans, and mortgage loans – impacts your score, too.

- New credit (10%): New accounts lower the average age of your existing accounts, which can negatively impact your score. Also, opening multiple accounts in a short period of time is considered “a risk” by reporting agencies.

source: myfico.com/credit-education/whats-in-your-credit-score