How to protect yourself from fraud

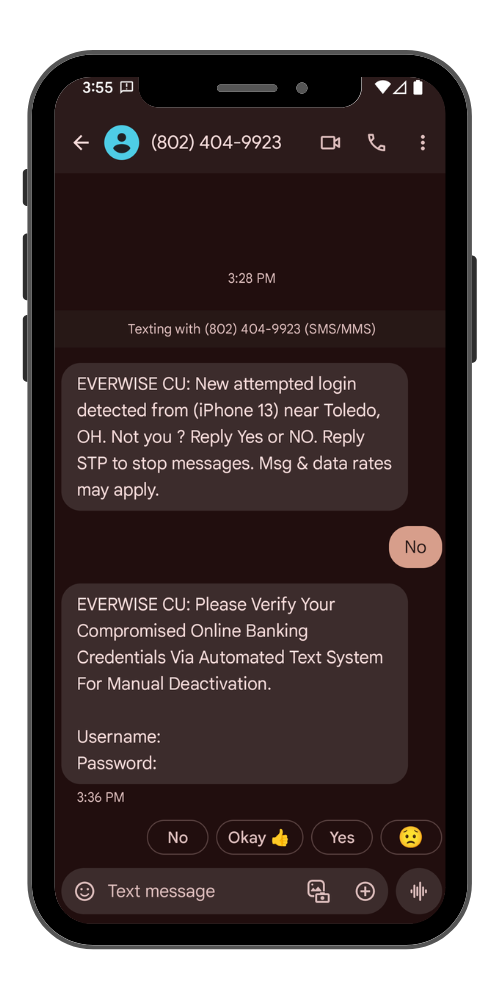

Luckily, you remember that your financial institution will never text, call, or email you to ask for your personal information. You decide not to respond to the message and instead open your mobile app and change your username and password. Minutes later, you receive a call from the same number claiming to be your credit union, and they inform you that if you do not provide your username and password, your money could be stolen. You trust your gut that this is most likely a scam, hang up on the fraudster, and contact your financial institution directly using the phone number you found from their website.

While many people believe this type of scam could never happen to them, the reality is that anyone can be targeted, and scammers continually find new ways to deceive individuals into divulging their information. This story is a real example of a spoofing attempt experienced by an Everwise employee, Zuzanna Zmud.

“As an employee of Everwise, I often get reminded of common scams affecting our members, but I never thought I could be nearly scammed myself!” says Zuzanna. “It’s such a scary feeling when a scammer tries to intrude into your life and steal your money, or even steal your identity. If I hadn’t been trained in how to handle scams through my workplace, I fear I may have fallen for this spoofing attempt. With how quickly technology is evolving, we all need to be vigilant in protecting ourselves against savvy scammers.”

In today's increasingly interconnected world, cybersecurity and fraud trends are evolving at an alarming speed. Spoofing attacks, like the one Zuzanna experienced, involve creating a deceptive front to trick individuals into sharing personal information. Cybercriminals utilize all available information to impersonate reputable organizations, often leading to identity theft—a crime affecting millions worldwide annually. Understanding the common tactics used by cybercriminals and adopting preventive measures can significantly reduce the risk of becoming a target in this digital age.

What should you do if you’ve been targeted by a spoofing attack?

- Remember, we will never call, email, or text to ask for your Everwise account or card information, secure access code, online banking username/password, or other account IDs, such as your Apple or Google ID.

- Always double-check the web address, email address, and phone number of any communication you receive using the company’s legitimate website. If there are errors or it seems like the message is trying to create a sudden sense of urgency, it is likely a scam.

- Do not respond to or click on any links in suspicious communications.

- When in doubt, reach out. Call our Member Services team at (800) 552-4745 to report the incident.

- Delete any text messages or emails from the scammer, and do not answer their phone calls.

What steps should you follow if your identity is stolen?

- Notify all affected creditors or banks

- Put a fraud alert on your credit report

- Check your credit reports

- Freeze your credit

- Report the identity theft to the FTC at www.identitytheft.gov or 877-438-4338

- File a complaint at ic3.gov if victimized on the internet

- Report identity theft to ChexSystems at www.chexsystems.com or 888-478-6536

- File a police report

- Remove fraudulent info from your credit report

- Change all affected account passwords

- Replace your stolen identification

- Contact your telephone and utility companies

The best way to protect yourself is to stay informed about the latest scams so you’re better prepared to handle anything that comes your way. Visit our Account Security & Protection page to learn about current fraud trends, tips to protect yourself online, how to keep your information off the Dark Web, and much more. Fraud can feel overwhelming, but by following these strategies and staying vigilant, you can be sure to safeguard your financial well-being.