Maximize Your Money: 10 Steps to a Better Checking Account

Here are some things to consider when opening your next checking account.

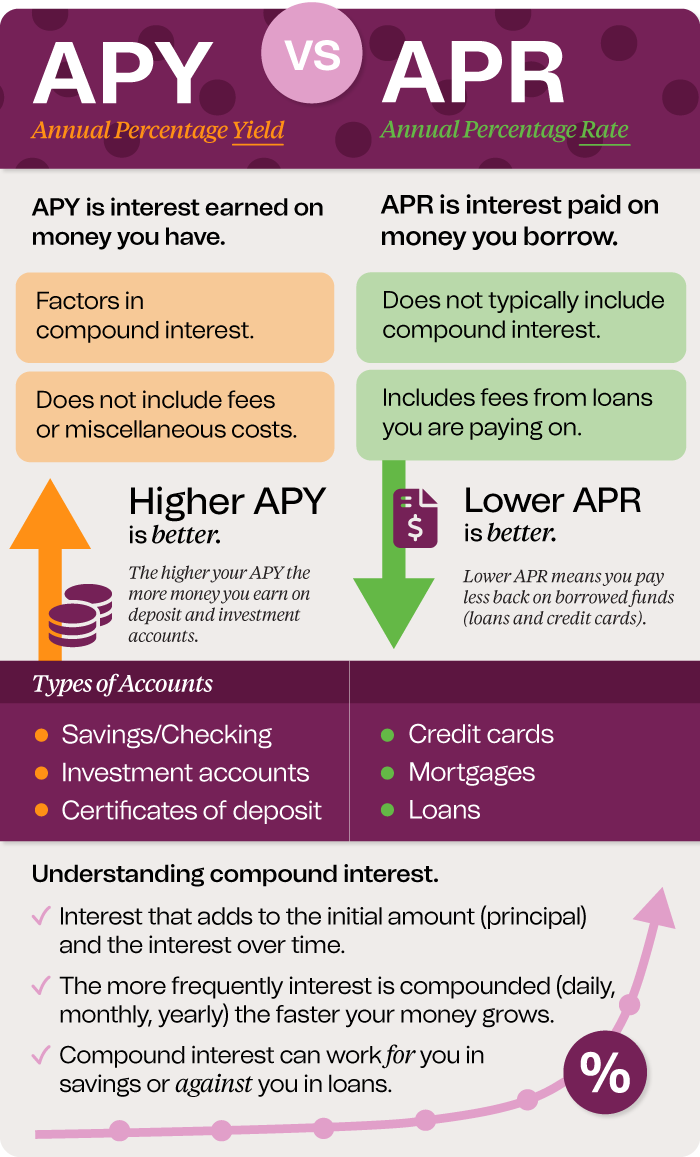

1. APY vs APR, what's the difference?

When discussing checking accounts, it’s important to have an understanding of the terms APY (Annual Percentage Yield) and APR (Annual Percentage Rate).

- APY is money you earn. It’s the rate at which your funds grow each year, and it factors in compound interest. If interest is compounded more often (like monthly or daily), your APY will be higher because you’re earning interest on your interest.

- APR is the cost of borrowing money. It’s shown as a yearly rate and includes interest and any additional fees. APR does not always factor in compound interest, in the same way APY does, it’s more about the overall cost of a loan or line of credit.

Knowing these differences will help you choose an account that best aligns with your financial needs and goals.

Tip: Our Ultimate Checking account, Boost Savings account, and Certificates all offer higher APYs!

2. Make saving automatic.

Want to save money without even thinking about it? When you set up automatic transfers from your checking account to your savings account, you can save for an upcoming vacation, a big household purchase, or even an emergency fund. The best part? Once your transfer is set up, you don’t have to remember to save each month because the work is done for you!

3. Round up savings.

Another smart and simple way to grow your savings is through a round up feature. The way this works is that individual debit card purchases are “rounded up” to the nearest dollar, and the difference is automatically deposited into your savings account. These smaller amounts create less of an impact on your spending and still help you save. A real win-win!

Tip: We offer a round-up add-on just like this. Check it out!

4. Use checking to build good credit.

Timely payments are just one factor that can positively impact your credit score. When you set up recurring payments out of your checking account, you can ensure that your regular bills are paid on time, every time. Automatic payments can help you avoid late fees and maintain a positive credit score, which can open the doors for more favorable loan terms and financial opportunities in the future.

Tip: Our Opportunity Checking and Accelerate Secured Credit Card, part of our Elevate Suite, are great tools to help those who need to build credit.

5. Earn cash back on purchases.

Some checking accounts offer cash back rewards on debit card purchases. This means you can earn rewards for the everyday items and services you buy. Use your cash back rewards toward future expenses or save them for a rainy day. Plus, using a debit card can help you avoid transaction fees at stores that charge for credit card processing.

Tip: Did you know at Everwise you can earn 0.5% cash back on debit card purchases?

6. Sniff out sneaky monthly fees.

Not all checking accounts are created equally, and account fees can vary widely. Watch out for fees related to maintaining a minimum monthly balance, account service charges, and different transaction fees.

To avoid these fees, choose a checking account that offers fewer restrictions or requirements that match your particular financial situation.

7. Read the fine print.

Always review the terms and conditions of your accounts to understand penalties and/or transfer limits, especially if you move money around your accounts more frequently. Knowing these details will help you better manage your accounts and avoid unnecessary charges.

8. Anytime, anywhere access.

Being able to access your money whenever and wherever you need it is a huge advantage to having a checking account. That's why opening a checking account with a bank or credit union that offers a large ATM network coupled with a user-friendly and reliable mobile app is crucial. Whether you're close to home or on the go, these key account features make sure that your money is always within reach, wherever life may take you.

Tip: Did you know that Everwise offers over 700+ no-fee ATMs and—through shared branching—has over 30,000 reduced-fee ATMs throughout the United States?

9. Get paid right away with direct deposits.

Direct deposits allow you to receive your paycheck, tax refunds, or government benefits directly into your account on the day the funds are issued. In addition, having a direct deposit can help you waive monthly maintenance fees, and you’ll spend less time waiting for checks to clear.

10. Stay safe and sound against fraud.

Modern-day checking accounts often include fraud detection and purchase protection. Suspicious activity is continuously monitored by your financial institution, and if your debit card is compromised, you can automatically lock a lost or stolen card in the Everwise Mobile Banking app.

Always stay alert with real-time notifications, balance alerts, and more to keep your account secure.

Tip: With Everwise's Advantage Checking, you can get free credit monitoring and other assistance if you suspect ID theft. Plus, get up to $300 for cellphone repairs or replacement if your phone is damaged.

Choosing your next checking account is about more than finding a place to store your money - it’s about managing your finances wisely, growing savings, working towards your financial goals, and earning rewards. Understanding and utilizing the features available to you will help you make the most of your account.