Create a budget.

We’re kicking off your financial wellness journey with tips on tracking your spending and creating and sticking to a budget. It will require discipline and attention, but it’s really important!

First, track your spending.

Tracking your spending is the first step. Mastering this skill is easier said than done. How can you track every dollar you spend when you make multiple purchases each day?

We’ve outlined how to track your spending in 4 easy steps.

1. Choose your tools.

Use a budgeting app, a spreadsheet, the good old-fashioned envelope system, or the simple method of writing things down on a piece of paper. Use whatever works for you to track your spending and find where you might be wasting money!

2. Review your income and outgoing expenses carefully.

Include your account statements, bills, and pay stubs. You can track the purchases you make by reviewing your monthly checking account and credit card statements at the end of the month.

3. Categorize your expenses and purchases.

You’ll need to save your bills and receipts, whether electronic or paper. At the end of the month, use your chosen tool to review all the purchases you’ve made throughout the month. When completing this step, don’t forget to include any automated payments you may rarely think about, such as subscription fees and insurance premiums. Make it easy by reviewing the subscriptions on your Everwise debit and credit cards with Everwise Mobile and Online Banking. Simply login and click on Card Connect from Card Services.

4. Keep a record of how much cash you withdraw and spend.

Regular cash withdrawals can sometimes slip through the cracks of our financial tracking. However, it's important to keep track of every dollar that's coming in or going out!

Now that you’ve tracked your spending and kept a careful record of where your money goes, you’re ready to move onto the next step of financial wellness: creating a budget.

Next, create and stick to a budget.

Creating a budget is one of the most vital parts of financial wellness, and it’s actually one of the simplest. As long as you keep paying attention as the month goes along and tracking your expenses, you’ll do great!

Create and stick to a budget in 5 easy steps:

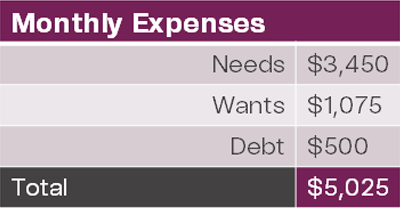

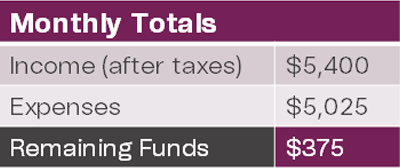

1. Tally up your total monthly expenses and all your streams of income.

If you've already completed part 1 of this guide and are tracking your spending, you're all set!

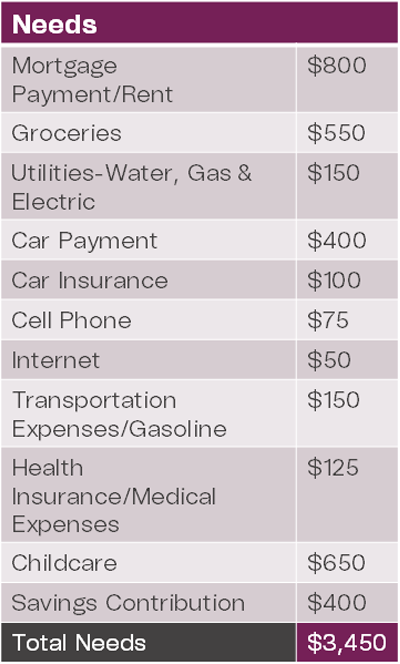

2. List your needs.

Include anything that is essential for living such as your rent or mortgage payments, savings, food, and clothing. Yes, emergency savings is essential. You’ll want to be prepared for unexpected expenses that may arise.

3. List your wants.

This includes anything not essential for living such as entertainment, brand-name clothing, and eating out.

4. Assign dollar amounts to your expenses.

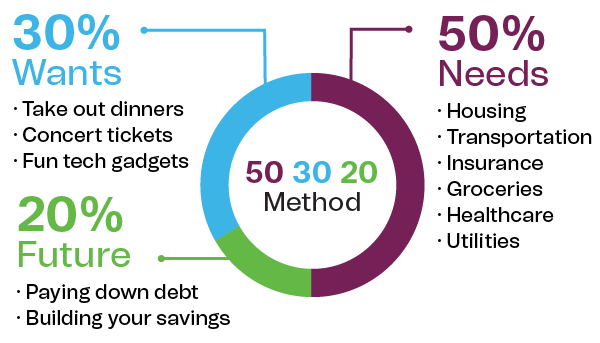

Your list of expenses should start with fixed-cost needs, then variable cost needs, and finally, your wants. Make sure the total does not exceed your estimated total for monthly expenses. And don’t forget other expenses that come up at different times of the year, like gifts, holiday expenses, or car insurance (which may be paid every six months or annually). A good rule of thumb is the 50/30/20 budget—spending roughly 50 percent of your after-tax dollars on necessities, no more than 30 percent on “wants,” and putting at least 20 percent into savings or paying off debts.

5. Review and tweak as necessary.

You will likely need to adjust the amounts in each expense category at least once every six months to keep your budget relevant. With inflation, you may even want to tweak it every three months.

Example budget:

Here is an example of a budget, to help you visualize how to organize it on paper.

Keep this up and you’ll be on top of your money in no time! You’ll know how you spend your money and will be able to adjust or eliminate non-essential purchases, reduce debt, increase savings, and meet other financial goals.

Learn more through our Creating a Budget and Building an Emergency Savings financial education modules.