Pay down debt.

If you been joining us on our Financial Wellness Journey, you've likely already tracked your spending and have designed a monthly budget. In this step, you’ll create a plan for paying down your existing debt. Paying down debt isn’t impossible if you strategize!

1. Create a budget to know your income, expenses, and cash flow.

If you didn’t do this earlier, now’s the time. You can look back at the previous article from our Financial Wellness Journey for a complete guide to tracking your spending and creating a budget.

2. Organize your debt.

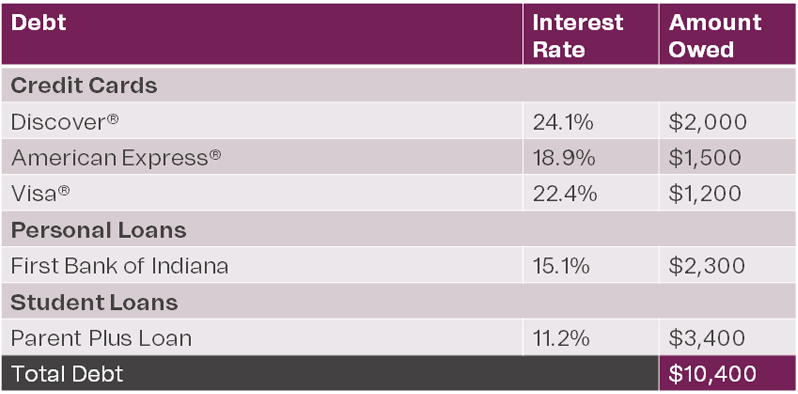

Before you get started, determine how much debt you have. List every credit card you own that has an outstanding balance and jot down the amount owed to each. Next, list the interest rate of each card. Do this for any other fixed installment loan debt you have, as well. These numbers will help you build a debt-payoff plan as described in the steps below. You can also add up the amounts owed on each account to reach your total outstanding debt amount.

3. Trim non-essential expenses and/or generate more income to have as much cash flow as you can.

By trimming your spending in one budget category and channeling that money toward paying down your debt, you can maximize your debt payments. You can also find ways to pad your pocket with extra cash for your payments, such as freelancing for hire or selling your creations on a platform, like Etsy, if you’re the crafty type.

4. Choose your debt-crushing method.

There are two main methods for paying down debt, called the Snowball or Avalanche methods:

The Snowball Method can keep you motivated by paying off your smallest debts first. Although its important to keep making the minimum payments on your other debts.

OR

The Avalanche Method can save you the most money by paying off debt with the highest interest rate first and moving on to the next-highest rate until all debts are paid off, while maintaining minimum payments on the rest of your debt.

5. Negotiate with your creditors.

Many credit card companies are willing to lower your interest rate once you prove you are serious about paying down debt. After kicking off your debt payment plan, contact each credit card company to discuss your options. At the very least, see if you can get the company to lower your rate.

6. Consider a debt consolidation loan or credit card balance transfer.

For some, the most challenging part of paying down debt is managing multiple payments across several credit card accounts. It can be complicated to remember them all and feel like the monthly payments are only going toward interest. When you consolidate debts to one low-interest loan, it’s a lot easier to manage the monthly payments. Plus, the savings on interest payments can be significant, especially if the new loan has a low interest rate.

If this approach sounds favorable, consider taking out an Everwise Personal Loan or making a balance transfer* to our Visa® Platinum credit card. These options may provide you with the funds you need to pay off your credit card bills and leave you with a single, low-interest monthly payment. Be sure to check balance transfer fees and do the math to ensure it is the right move for you. At Everwise the balance transfer fee for our Visa Platinum, Visa Signature Reward, and Visa Accelerate credit card is the greater of $10 or 2% per transaction.

*Be sure to check if there is a balance transfer fee and do the math to ensure it is the right move for you.

7. Avoid debt settlement services.

Debt settlement services offer to lower your interest rates and boost your credit score in a short amount of time – for a fee. Although many of these companies could be fronts for scammers and should be avoided, there are legitimate debt settlement companies, so do your research well if you are thinking of using one.

8. Start building your emergency savings and stop taking on new debt.

Having an emergency savings can help you from taking on new debt due to unexpected expenses. Be sure to include emergency savings in your budget.

Paying off debts takes time and willpower, but living debt-free is key to financial wellness.

Promotional content related to product page

Learn more about climbing out of debt with our Debt Management learning module.