|

|

|

|

|---|---|---|---|

| Best for | Everyday spenders, those new to banking, and anyone who wants a stress-free banking option | Busy professionals, frequent cash users, or those looking for added perks | Savers, planners, or members that tend to keep higher balances in their accounts |

| Monthly fee1 | $0 | $0 or $10 | $0 or $20 |

| Monthly fee waiver | Waived with $2,000 in average monthly balance or $2,000 in electronic deposits | Waived with $4,000 in average monthly balance or $4,000 in electronic deposits | |

| Minimum to open |

$0

|

$0

|

$0 |

| Cash back on debit card purchases 2 |

0.25%

|

0.35%

|

0.35% |

| Get paid up to 2-days earlier 3 | Yes | Yes | Yes |

| Everwise fee waiver at non-Everwise ATMs 4 |

None

|

Two (2) per month

|

Four (4) per month |

| Dividends on balances |

None

|

None

|

3.00% APY on balances up to $10,000* |

| Free check orders 5 |

|

Up to 1 check order per year

|

Up to 2 check orders per year |

| Open Simply | Open Plus | Open Max |

Checking with something for everyone.

Ready for a smarter way to bank?

Our accounts come packed with features that make managing your money easier and more rewarding.

Just maintain the required monthly average balance or electronic deposits.

Earn cash back on every purchase with your Everwise Debit Mastercard.®

You could get paid up to two days sooner with EarlyPay.

Compare our checking accounts.

Swipe to the right to view all accounts.

Max Checking

| Balance Required to Earn Dividends | Rate | APY* |

|---|---|---|

| Up to $10,000 | 2.96% | 3.00% |

| Greater than $10,000 | 0.10% | 0.10% |

Free6 Greenlight for families.

Join more than 6 million families who already trust Greenlight to help them raise financially confident kids.

- Connect Greenlight debit cards to your Everwise checking, and manage everything in the app.

- Customizable parental controls keep you informed and in charge.

- Greenlight Level UpTM makes learning about money simple, safe, and fun.

Get Started

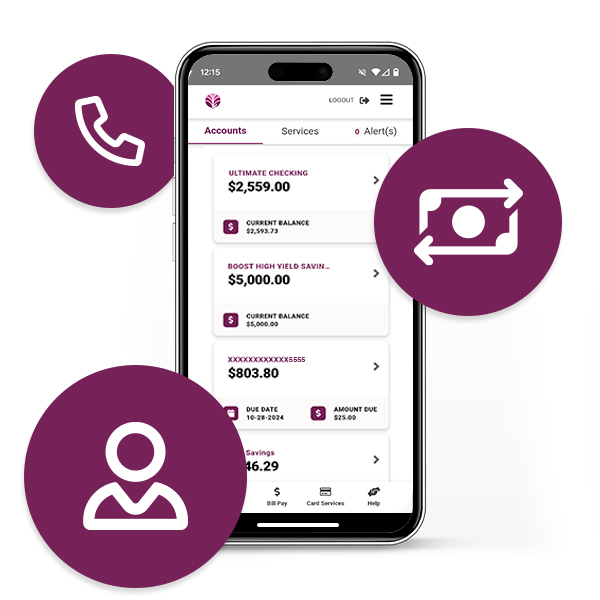

Easy mobile and online banking.

Transfer funds, pay bills, and manage your cards all in one place.

Mobile & Online Banking

Promotional content related to product page

Want to save even more? Pair your checking with a Boost savings account to earn dividends on your savings too.

Debit card rewards, perks, and peace of mind.

- Get your card instantly at most Everwise locations. Visit our locations page and look for "Debit Cards Issued Instantly" under Branch Features.

- Earn cash back on all debit card purchases, and shop confidently with Mobile Wallet.

- More than 700 free ATMs across Indiana, and 30,000+ surcharge-free ATMs nationwide. 4

- Save effortlessly with Round-Up Savings. Each time you make a purchase with your Debit Mastercard, we'll round up the change and automatically transfer it to your savings.

Think about all the things you buy every week. That can add up to lots of money spent — and the potential for plenty of cash back. Here are a couple ways to claim your debit rebate:

- Log into online banking, click on the Debit Rebate tile to check your balance or cash in your rebate.

- Stop by your local branch and speak to an Everwise employee.

- Call Member Services at (800) 552-4745.